BizCore System Setup: Configuring Tax Rates

Tax Rates in BizCore are used to apply specific percentages of tax to invoices, estimates, and other financial documents. Properly configuring tax rates ensures that your business complies with local tax regulations and that your billing remains accurate and professional.

This guide walks you through the process of adding new tax rates in BizCore.

Access the Setup Menu

1. Log in to the BizCore Admin Panel using administrator credentials.

2. In the left-hand navigation menu, click Setup.

3. Under Setup, click Finance to expand the finance-related options.

4. Select Tax Rates from the dropdown list.

You will be directed to the Tax Rates management page, where existing tax rates are displayed.

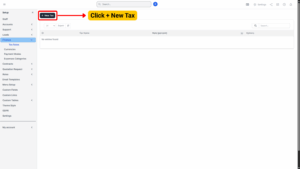

Add a New Tax Rate

1. On the Tax Rates page, click the + New Tax button located at the top-right corner of the screen.

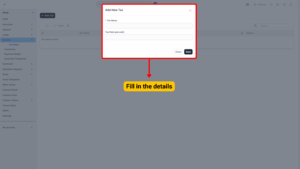

2. A form will appear for creating a new tax rate.

Configure the Tax Rate

Fill in the required fields:

| Setting / Field | Description |

|---|---|

| Tax Name (Required) | Enter a descriptive name for the tax. Use clear names so users can easily identify the tax on invoices and reports. |

| Tax Rate (Percent) (Required) | Enter the percentage rate of the tax (e.g., 6 for 6%, 10 for 10%). This rate will be automatically applied when the tax is selected on invoices or estimates. |

Save the Tax Rate

1. Review the information you have entered for accuracy.

2. Click the Save button to create the tax rate.

Your new tax rate will now appear in the Tax Rates list and will be available for selection whenever you create invoices, estimates, or other financial records in BizCore.

Setting up Tax Rates in BizCore ensures that your financial documents reflect accurate and compliant tax information. By correctly naming and setting percentages, you can streamline the billing process, reduce manual calculation errors, and maintain a professional appearance for your clients.