How to Applied Debit & Payment Record

Overview

The Applied Debit & Payment Record feature allows businesses to efficiently manage invoice settlements, including:

– Applying debit notes to reduce the outstanding balance of a vendor invoice.

– Recording full or partial payments against vendor invoices.

– Ensuring accurate tracking of all financial transactions associated with each invoice.

– Providing clear visibility into outstanding amounts and applied adjustments.

This functionality helps maintain clean accounts payable, minimizes errors, and supports transparent financial reconciliation.

Applied Debit

What is an Applied Debit?

An Applied Debit is used to reduce the amount payable on a vendor invoice by applying an open Debit Note. For example, if a vendor invoice is RM5,000 and the buyer has a Debit Note worth RM1,000, applying the debit will reduce the outstanding balance to RM4,000.

Steps to Apply Debit to an Invoice

Step 1: Access Invoice Details

1. Navigate to the Purchase Module.

2. Open the Invoices menu.

3. Select the unpaid or partially paid invoice that you want to apply the debit to.

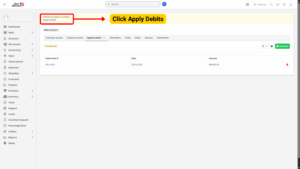

Step 2: Apply Debit

1. In the invoice detail page, click the “Apply Debits” button.

2. The system will display:

Debit Available – the total remaining amount of all open Debit Notes associated with the same vendor as the invoice.

List of Debit Notes – only Debit Notes with Open status are shown.

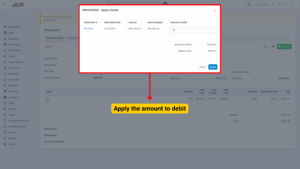

Step 3: Enter Amount

1. Enter the Amount to Debit in the field provided.

2. Click “Apply” to confirm.

Example:

Invoice amount = RM5,000

Available Debit = RM1,000

Amount to Debit = RM1,000

New Outstanding = RM4,000

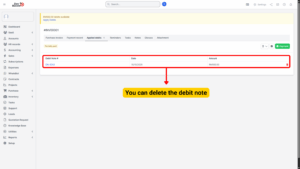

Deleting Applied Debits

If an applied debit was added incorrectly or needs to be reversed, it can be deleted.

Step 1: Open Applied Debits Tab

– Go to the “Applied Debits” tab in the invoice detail page.

Step 2: Delete Debit

– Click the trash icon next to the debit entry.

– Confirm the deletion in the pop-up dialog.

Once deleted:

– The invoice outstanding balance will increase accordingly.

– The associated debit note will revert back to Open status (if applicable).

Note

Only users with appropriate permissions can delete applied debits.

Payment Record

What is a Payment Record?

A Payment Record is a transaction record that reflects partial or full settlement of a vendor invoice.

It allows businesses to:

– Record payment details,

– Track different payment modes (e.g., bank transfer, cheque, cash),

– Support multi-payment scenarios (e.g., split payments), and

– Maintain a clear audit trail.

Steps to Record a Payment

Step 1: Access Invoice Details

1. Navigate to Purchase → Invoices.

2. Select an invoice with status Unpaid or Partially Paid.

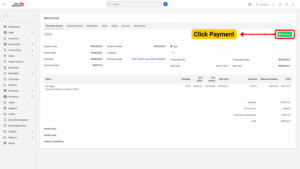

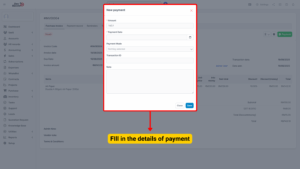

Step 2: Add a Payment

1. Click the “Payment” button at the top of the invoice detail page.

2. The New Payment form will appear.

Step 3: Fill in Payment Information

| Field | Description |

|---|---|

| Amount | Enter the amount being paid. |

| Payment Date | Specify the date of the transaction. |

| Payment Mode | Select from available modes (e.g., Cash, Bank Transfer, Cheque, e-Wallet, etc.). |

Example:

If the invoice amount is RM5,000, and you’re paying RM2,000, the invoice will show:

– Paid: RM2,000

– Outstanding: RM3,000

Step 4: Save and (If Applicable) Approve

1. Click “Save” to create the payment record.

2. If the Payment Request Approval Process is enabled:

– The payment will be in Pending Approval status.

– An approval request notification will be sent to designated approvers via email or in-app notifications.

– Approvers must log in and either Approve or Reject the payment.

Once approved, the invoice payment status is updated accordingly.

Deleting Payment Records

Incorrect or duplicate payments can be removed.

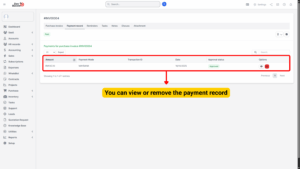

Step 1: Open Payment Record Tab

– Go to the “Payment Record” tab within the invoice detail page.

Step 2: Delete Payment

1. Click the trash icon next to the payment entry.

2. Confirm the deletion.

After deletion:

1. The invoice balance is updated to reflect the unpaid amount.

2. The audit log records the deletion for accountability.