Recording Invoices Payments

Recording a payment links the customer’s remittance to the correct invoice and updates balances in real time. Follow these steps carefully to avoid reconciliation issues.

Prerequisites

– Invoice status = Sent. (Draft or Cancelled invoices should not receive payments.)

– You know the exact amount, date, and method used (e.g., bank transfer, card, cash).

Record Payment

1. Open the Invoice

– Go to Invoices and select the invoice you’re applying the payment to.

– Confirm key details (customer, currency, total, outstanding balance).

Note

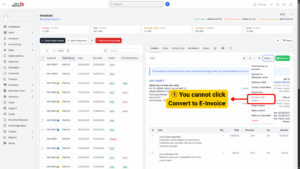

The button is disabled as the payment has not been recorded.

2. Click +Payment

– This opens the Record Payment form tied to the current invoice.

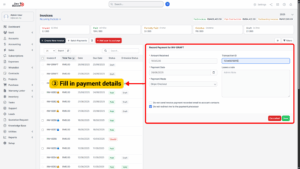

3. Fill in Payment Details

a) Amount Received:

– Enter the exact amount received.

– If it’s less than the outstanding balance, the invoice will become Partially Paid.

– If it matches the outstanding balance, the invoice will become Paid.

b) Payment Date:

– Use the actual transaction date shown on the bank statement or gateway report (important for aging and period-end reporting).

c) Payment Mode:

– Choose the method used by the customer.

d) Transaction ID / Reference:

– Enter the bank reference, gateway transaction ID, or cheque number.

– This is essential for audit trails and investigating disputes.

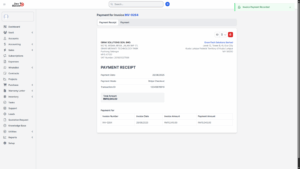

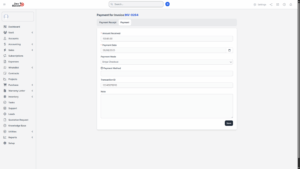

4. Click Save to Confirm

– The system posts the payment and links it to the invoice.

You’ll see:

a) Payment Receipt generated automatically (view/print/download PDF).

b) Payment Details updated under the invoice (amount, date, mode, reference).

Note

Pre-Conversion Requirements

Before the Convert to E-Invoice option becomes available, the system will automatically check whether all mandatory fields are completed and valid. These may include:

Customer Information: The customer’s name, billing address, and Tax Identification Number (TIN) must be accurate and verified.

Invoice Details: The invoice number, date, line items, descriptions, and tax rates must follow the proper format.

Payment Status: The invoice must be marked as Sent, and in some cases, partial or full payment may be required before conversion.

Tax Information: GST/SST (if applicable), tax amounts, and calculation methods must be correct.

If any of these conditions are missing or invalid, the Convert to E-Invoice

button will appear grayed out (disabled).