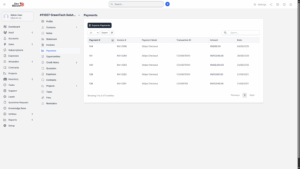

Payments

The Payments section provides a complete record of all financial transactions made by a customer. It serves as a centralized place where businesses can track, verify, and manage payment activity across invoices and accounts. This ensures transparency between the company and its clients, while also simplifying reconciliation and financial reporting.

Payment History

When you access the Payments section, you will see a detailed payment history table that includes:

a) Payment Date – The exact date the payment was received.

b) Payment Amount – The total value of the transaction.

c) Payment Mode – The method used for the payment (e.g., Bank Transfer, Cash, Cheque, Credit Card).

d) Reference or Transaction ID – The unique identifier linked to the payment for tracking purposes.

e) Linked Invoice(s) – Shows which invoices the payment was applied to.

Export Options

To support reporting and data management, payment records can be exported into several formats:

a) Excel (XLS/XLSX) – Ideal for further analysis, filtering, and reconciliation tasks.

b) PDF – Generates a professional, read-only version of the payment records, suitable for sharing with clients or auditors.

c) CSV (Comma-Separated Values) – Useful for importing data into other accounting systems or databases.

d) Print – Provides a hard copy version for filing, meetings, or audit records.

Benefits of Payment Records

a) Financial Transparency – Clients and businesses can see exactly how and when payments were made.

b) Centralized Tracking – All payment activity is stored in one place for quick access.

c) Export Flexibility – Multiple formats ensure compatibility with accounting systems, compliance checks, and reporting needs.

d) Improved Reconciliation – Helps finance teams match payments with invoices and identify any discrepancies.

e) Audit Support – Exported or printed records provide solid documentation for tax and legal compliance.