Creating a New Credit Note

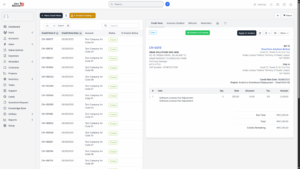

A Credit Note is an official document issued by a business to a customer, typically to acknowledge a reduction in the amount owed by the customer. It serves as a correction or adjustment to an earlier invoice. Credit notes are essential in situations such as product returns, incorrect billing, price revisions, discounts, or damaged goods.

In Malaysia, all credit notes must follow the LHDN (Lembaga Hasil Dalam Negeri) requirements to ensure tax compliance. This means that when you create a credit note, you must specify a valid Reason Code and ensure all calculations align with the original invoice.

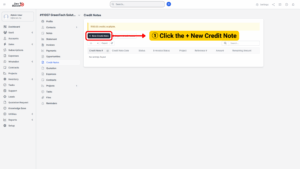

Access the Credit Note Section

1. From the main sidebar menu, navigate to Accounts.

2. Under the Accounts module, click Credit Notes.

3. You will be redirected to the Credit Notes dashboard, where all previously issued credit notes are listed.

4. To create a new one, click the + New Credit Note button.

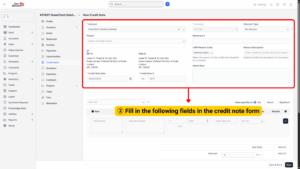

Complete the General Credit Note Information

1. On the new credit note form, provide the following details carefully:

a) Project – Select the related project if the credit note is linked to a particular client project.

b) Credit Note Date – Enter the official issue date of the credit note. This date should match the period when the adjustment is being recorded.

c) Discount Type – Define how discounts are applied, choosing between Before Tax, After Tax, or No Tax.

d) Reference – Provide a unique reference number for tracking purposes. This could be linked to the original invoice or an internal accounting code.

e) LHDN Reason Code – Select the official code that matches the reason for issuing the credit note (explained in Step 3).

f) Reason Description – Add a detailed explanation for the adjustment to support the chosen code.

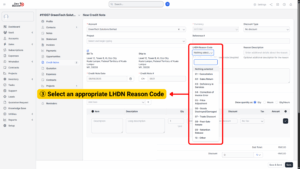

2. Select the Correct LHDN Reason Code

The Reason Code is mandatory for compliance with LHDN guidelines. The code you select must reflect the exact reason for issuing the credit note. Below are the available codes and when they should be used:

01 – Cancellation: Used when the original invoice has been completely voided.

02 – Sales Return: When goods sold are returned by the customer.

03 – Deficiency in Services: If the service provided was incomplete or not as promised.

04 – Correction of Invoice Error: For correcting errors such as wrong quantities, incorrect prices, or inaccurate tax entries.

05 – Price Adjustment: When a price reduction is agreed upon after invoicing.

06 – Goods Destroyed/Damaged: For goods that were damaged in transit, expired, or destroyed.

07 – Trade Discount: When additional trade discounts are given after the invoice has been issued.

08 – Post-Sale Rebate: For rebates or allowances granted after the sale.

09 – Retention Release: Common in construction contracts, used when retention sums are released.

10 – Other: For cases not covered by the above codes (requires a clear explanation in the Reason Description).

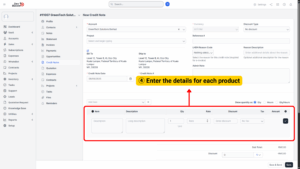

3. In the Items section, click Add Item or

4. Fill in the following details for each item:

a) Item Name – Name of the product/service.

b) Description – A detailed explanation of the item being credited.

c) Quantity – The number of units being returned or adjusted.

d) Rate – The unit price of the item.

e) Discount – Apply any applicable discount.

f) Tax – Select the tax type applied in the original invoice.

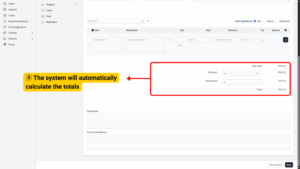

5. Once entered, the system will automatically calculate the total.

6. Double-check all details to ensure accuracy: project, invoice reference, reason code, and item amounts.

7. Verify that the Grand Total matches the actual adjustment required.

8. Once confirmed, click Save.