How to Process a Refund from a Credit Note

In certain scenarios, customers may be entitled to receive a cash refund instead of applying their credit balance to future invoices. This situation typically arises when:

– A customer cancels an order.

– Goods are returned.

– The client requests repayment rather than retaining the balance as credit.

The system provides a straightforward and structured process to handle refunds directly from credit notes, ensuring accurate financial records and proper tracking of customer transactions.

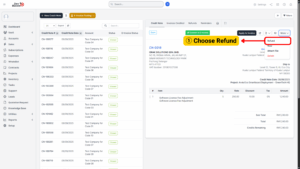

Access the Credit Note

To initiate a refund, start by locating the relevant credit note:

1. From the sidebar navigation panel, go to Sales and select Credit Notes.

2. The dashboard will display a list of all issued credit notes.

3. Locate the credit note associated with the customer or transaction eligible for a refund.

4. Click the credit note to open its detailed view.

5. In the top-right corner, click the More dropdown menu.

6. Select Refund from the dropdown options.

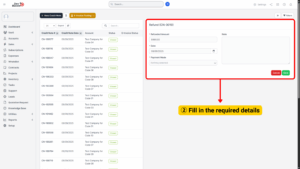

Provide Refund Information

Once the Refund option is selected, a form will appear to capture all relevant details of the refund transaction. Accurate entry is essential for maintaining both customer records and financial reporting integrity.

Fill in the following fields:

| Field | Description |

|---|---|

| Refunded Amount | Enter the total sum of money to be reimbursed to the customer. |

| Refund Date | Specify the exact date when the refund is processed. This should match the actual payment transfer date, cheque issue date, or cash handover date. |

| Payment Mode | Select the method used to return funds (e.g., bank transfer, cheque, cash, or online payment). |

| Additional Notes (Optional) | Provide any relevant information about the refund (e.g., reason for refund, transaction reference, or special instructions). |

Review and Save

Before finalizing the refund:

1. Double-check all entries, including the refunded amount, refund date, and payment mode.

2. Confirm that the selected payment method matches the actual transfer or transaction.

3. Once verified, click Save to process the refund.

The system will record the refund, update the credit note balance, and reflect the transaction in both customer records and financial reports.

Summary

Processing refunds from credit notes is a key function in maintaining accurate customer accounts and ensuring compliance with financial reporting standards. By following the structured process of accessing the credit note, entering refund details, reviewing, and saving, businesses can:

1. Correctly reimburse customers.

2. Keep precise records for audits and reporting.

3. Maintain transparency and trust in customer transactions.

Proper refund management not only protects the company’s financial integrity but also improves overall customer service.