Sales Module – Credit Notes

The Credit Note feature in BizCore allows businesses to issue adjustments to previously generated invoices. A credit note reduces the amount a customer owes or records refunds for cancelled orders, returned goods, service errors, or other reasons. It is an essential financial document for maintaining accurate records and complying with tax regulations.

BizCore supports automated calculations, discount handling, tax adjustments, and includes LHDN Reason Codes for compliance with Malaysia’s e-Invoice requirements.

This article explains how to create, configure, and manage credit notes within the Sales Module, including reason codes, item entry, and best practices.

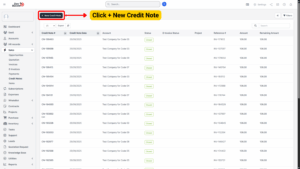

Accessing the Credit Note Section

To create or manage credit notes:

1. From the Main Dashboard, click Sales in the sidebar menu.

2. Select Credit Notes.

3. You will see a list of all issued credit notes, including details such as number, date, account, and status.

4. To add a new record, click + New Credit Note.

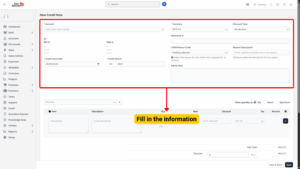

Creating a New Credit Note

Follow these steps to create a new credit note:

1. In the Credit Notes section, click + New Credit Note.

2. Fill in the required credit note details.

Credit Note Details

Each field defines important information for the credit note. Required fields are marked with (*).

| Field | Description |

|---|---|

| Account (Required) | Select the customer account to which this credit note applies. |

| Bill To | Enter the billing address details for the customer. |

| Ship To | Enter the shipping address (if relevant). |

| Credit Note Date (Required) | Select the date the credit note is issued. |

| Credit Note # (Required) | The system auto-generates a unique credit note number (can be customized based on system settings). |

| Currency (Required) | Choose the transaction currency (e.g., MYR, USD). |

| Discount Type | Define how discounts are applied: No Discount, Before Tax, or After Tax. |

| Reference # | Enter an optional reference (e.g., related invoice number). |

| LHDN Reason Code (Required for e-Invoice) | Select the reason for issuing the credit note: – 01 – Cancellation – 02 – Sales Return – 03 – Deficiency in Services – 04 – Correction of Invoice Error – 05 – Price Adjustment – 06 – Goods Destroyed/Damaged – 07 – Trade Discount – 08 – Post-Sale Rebate – 09 – Retention Release – 10 – Other |

| Reason Description | Optional – provide a more detailed explanation of the reason. |

| Admin Note | Add internal notes for administrators or finance staff (not visible to the customer). |

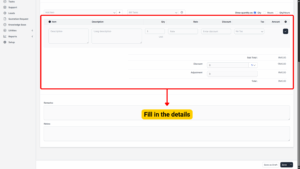

Adding Items to the Credit Note

After filling in the general details, add the relevant items to adjust or refund.

| Field | Description |

|---|---|

| Item | Select or enter the product/service being credited. |

| Description | Provide additional details about the item. |

| Qty | Enter the quantity being credited (e.g., returned or cancelled). |

| Rate | Enter the unit price of the item. |

| Discount | Apply item-level discounts if applicable. |

| Tax | Select the appropriate tax rate. |

The system will automatically calculate the Sub-Total.

Applying Discounts and Adjustments

Once items are added:

– Apply an Overall Discount (percentage or fixed amount) if needed.

– Enter any Adjustments (e.g., additional deductions or corrections).

The system recalculates the Grand Total instantly.

Managing Credit Note Details After Creation

Once saved, credit notes can be further managed and tracked.

| Action | Description |

|---|---|

| Update Status | Change the status as needed. |

| Edit Credit Note | Revise customer details, items, or reason codes. |

| Attach Files | Upload supporting documents such as return forms, correspondence, or proof of damage. |

| Apply Refund | Issue a refund against the customer’s payment, if required. |

| Allocate to Invoice | Apply the credit against an existing invoice to reduce the outstanding balance. |

Saving the Credit Note

Once all fields are complete:

1. Review the credit note for accuracy, especially LHDN Reason Codes for compliance.

2. Click Save.

The credit note will appear in the Credit Note List, where it can be monitored, allocated, or refunded.