Applying a Credit Note to an Invoice

A Credit Note is a financial document used to correct or adjust a customer’s outstanding balance. Rather than issuing a cash refund immediately, businesses often allow customers to offset the value of a credit note against unpaid or partially paid invoices. This method helps maintain financial accuracy, reduces unnecessary refund transactions, and provides a clear audit trail for how customer credits are managed.

Applying credit notes to invoices is a critical accounting process. Proper application ensures compliance with tax regulations and accounting standards, including those set by LHDN (Lembaga Hasil Dalam Negeri).

Eligibility for Applying Credit Notes

Not all invoices are eligible for credit note application. The following rules apply:

| Rule | Details |

|---|---|

| Fully Paid Invoices | Credit notes cannot be applied to invoices that are already fully settled. |

| Open, Unpaid, or Partially Paid Invoices | Credit notes can only be applied to invoices with outstanding balances. |

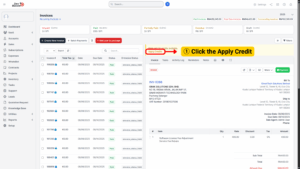

Navigate to the Invoice

1. Go to the Invoices list in the system.

2. Select the invoice you want to adjust with a credit note.

3. Open the invoice details to review the outstanding balance and ensure the invoice qualifies for credit application.

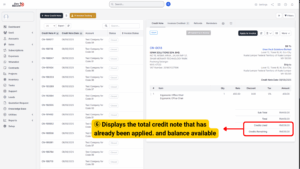

Check Available Credits

1. Within the invoice, the system displays Total Credits Available for the selected customer.

2. This total represents all valid credit notes issued to the customer but not yet fully used.

3. If credit notes are available, the Apply Credit option will be visible.

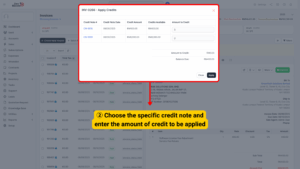

Select and Apply the Credit Note

1. Click Apply Credit to open the list of active credit notes linked to the customer.

2. From the list, select the specific credit note to be applied.

3. Enter the amount of credit to be applied to the invoice.

– Ensure the amount does not exceed the remaining balance of the invoice.

4. Confirm the selection and click Apply to complete the process.

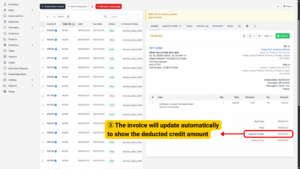

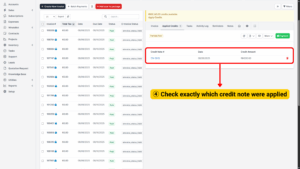

Verify Adjustments on the Invoice

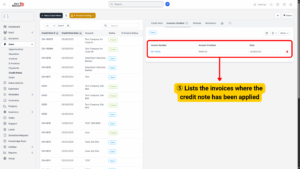

The system allows you to monitor how credit notes are being used across different invoices.

| Feature | Description |

|---|---|

| Invoice Record | Displays which credit note(s) were applied and the specific amounts used. |

| Multiple Credits | If more than one credit note is applied, each credit’s details are shown separately. |

| Credit Note Details | Within the credit note itself, the following are tracked:

– Invoices Credited: List of invoices where the credit was applied. – Credit Used: Total portion of the credit that has already been applied. – Credit Remaining: Balance still available for future application. |

Applying credit notes is an essential function in managing customer accounts. By following the correct procedures, businesses can:

1. Adjust customer balances accurately.

2. Maintain compliance with accounting standards and tax regulations.

3. Provide a clear record of credit usage for both internal accounting and customer transparency.

Properly applied credit notes reduce errors, simplify financial tracking, and help businesses maintain healthy customer relationships while keeping records audit-ready.