Editing and Updating Invoice Details

Managing invoices is one of the most critical processes in any organization’s financial operations. An invoice not only serves as a request for payment but also acts as a legally binding document that records the exchange of goods or services. Properly managing invoices helps ensure cash flow stability, financial accuracy, and compliance with company policies.

This guide provides a detailed walkthrough of all available options for editing, updating, and managing invoices within the system — including viewing, downloading, and printing, changing statuses, and taking additional actions through the More menu.

Overview of Invoice Management

Invoices typically move through several stages before they are considered fully complete. This process usually begins with creating an invoice, validating its accuracy, sharing it with the client, and finally recording its payment or adjusting it if necessary.

Efficient invoice management ensures:

a) Accurate financial reporting – preventing errors in ledgers and cash flow.

b) Smooth customer experience – by providing timely, professional-looking invoices.

c) Audit readiness – by maintaining a clear record of changes, statuses, and supporting documents.

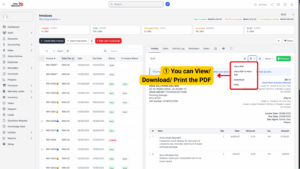

Viewing, Downloading, and Printing Invoices

The first step in managing invoices is to view and verify their content. The system offers multiple options to access the invoice in different formats, suitable for various use cases.

| Option | Description |

|---|---|

| View in PDF | Opens the invoice in a professional PDF layout, making it easy to read and share with clients. |

| Download | Saves a copy of the invoice to your computer for record-keeping or manual email sending. |

| Generates a physical copy of the invoice for clients who need hard copies or for filing purposes. |

Invoice Statuses and Actions

When you open an invoice in the system and click the More button, you will see several additional actions you can perform include change the invoice status. These options provide flexibility in managing and customizing your invoices.

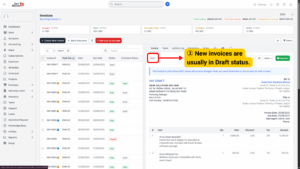

1. Draft

| Aspect | Details |

|---|---|

| Purpose | Represents a work-in-progress invoice that has not yet been finalized. |

| Key Characteristics | – Fully editable: customer details, product lines, quantities, and prices can be updated. – No impact on accounting or financial reports. – Can be safely deleted without leaving a trace in the reporting system. |

| When to Use | – During initial invoice preparation. – When waiting for internal approval before sending to a client. – When multiple revisions may be required before confirmation. |

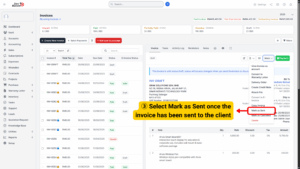

2. Sent

| Aspect | Details |

|---|---|

| Purpose | Indicates that the invoice has been shared with the client and is now considered official. |

| Key Characteristics | – Marks the invoice as active and ready for payment. – Editing may be restricted based on system settings. – Any change may require administrative privileges or the creation of an amendment. |

| When to Use | – Immediately after emailing or delivering the invoice to the customer. – To start payment follow-ups or reminders. |

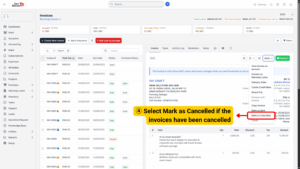

3. Cancelled

| Aspect | Details |

|---|---|

| Purpose | Used when an invoice is no longer valid but must remain in records for audit purposes. |

| Key Characteristics | – Remains in the system but is excluded from financial totals, payment tracking, and reports. – Ensures a full historical trail for auditing and compliance. |

| When to Use | – Invoices with incorrect details. – Duplicate invoices. – Orders that have been cancelled by the customer. |

More Options in Invoice

| Option | Description | Purpose/Benefit |

|---|---|---|

| View Invoice as Account | Displays invoice from the accounting perspective, including debit/credit accounts, tax details, and ledger entries. | Useful for accountants or finance officers to verify how the transaction is reflected in company accounts. |

| Convert into Warranty Letter | Converts an invoice into a warranty letter using invoice details (product, date, customer info). | Provides customers with proof of warranty linked to their purchase. |

| Convert into Delivery Order (DO) | Converts an invoice into a delivery order for confirming goods delivery. | Ensures logistics or warehouse teams know what items to ship while keeping records connected. |

| Create Credit Note | Automatically generates a credit note linked to the original invoice when goods are returned, refunds are issued, or there are errors. | Adjusts balances and keeps financial records accurate. |

| Attach File | Allows uploading of supporting documents (e.g., purchase orders, agreements, receipts, product images). | Centralizes documentation for easy reference and transparent record-keeping. |

| Copy Invoice | Creates a duplicate of the invoice with the same details. | Saves time for repeated or recurring orders by avoiding re-entry of details. |

| Delete Invoice | Removes the invoice from the system (usually only if in Draft status). | Helps maintain clean records, but must be used carefully as it cannot be recovered. |

Step-by-Step Guide for Updating an Invoice

1. Open the Invoice:

Navigate to the invoice list and select the invoice you want to update.

2. Review Current Status:

Check whether the invoice is in Draft, Sent, or Cancelled status.

– If Draft, you may proceed with full editing.

– If Sent, verify if your role permits editing. Otherwise, use credit notes for adjustments.

1. Edit Details:

Update customer details, line items, quantities, or taxes as necessary.

2. Attach Supporting Documents (Optional):

Use the Attach File option to upload purchase orders, agreements, or receipts.

3. Save Changes:

Click Save or Validate to confirm the updates. If the invoice is ready, mark it as Sent.